For more information about Market Data on 31.01.2019 click

“Albanian Banking Sector is well-capitalized, liquid and profitable”- writes International Monetary Fund in the last report about Albania, adding that, regardless of these strong points there is needed more efforts to improve elasticity.

“Financial sustainability indicators are improved, with average rates of capital and assets that have exceeded the minimum required from banking regulators” – it is expressed between the lines. The liquidity of banking sector is evaluated very high, but this also comes because of lending weakening.

IMF also highlights challenges of banking sector. One of the challenges is new, which is referred to European banks exiting the domestic market. This fact increases the challenges regarding supervision, expresses the institution based on Washington. IMF clarifies that, leaving or the plan of the European banks to leave Albania during the last 2 years is the result of their strategy to get out from the South Eastern Europe region and Balkan.

Banks ownership is being transferred to domestic banks and to non-european groups, highlights the institution.

IMF also focuses to Albanian Securities Exchange. Development of capital markets will strengthen financial intermediation and support the domestic economical development.

Capital Markets in Albania are expanding, but are limited only in government securities and inside trade.

Roel Korkuti/SCAN

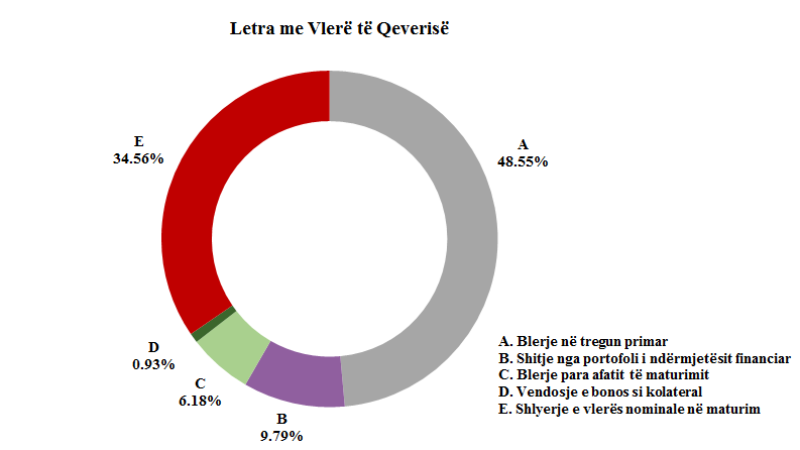

Statistical data on the Government securities retail market for the year 2018, indicate that the market was dominated by transactions “Purchase in the primary market” and “Payment of nominal value on maturity date” with respectively 48.55% and 34.56% of the total volume.

Transactions of the individual investors, dominate at the Government securities secondary market with 98.85% of all transactions in the market.

Graphic: Government Securities for the year 2018

| A – Purchase on the primary market |

| B – Sales from financial intermediary portfolio |

| C- Purchase prior to maturity |

| D- Pledging Government securities as collateral

E- Payment of nominal value at maturity |

During the year 2018, the B type transactions “Sales from financial intermediary portfolio” increased by ALL 484 million or 10.32% and the number of transactions increased by 0.68% compared with the year 2017.B and C Type Transactions

During the year 2018, the C type transactions “Purchase prior to maturity” increased by ALL 694 million or 27.00% and the number of transactions also increased by 0.10% compared with the year 2017.

During the year 2018, there was an increase in the absolute total amount of the transactions of B and C type, by about ALL 1,177 million compared with the year 2017.

For more information about Market Data on 29.01.2019 click

Read More

For more information about Market Data on 22.01.2019 click

Read More

For more information about Reported Transaction (OTC) on 21.01.2019 click

Read More

For more information about Reported Transaction (OTC) on 16.01.2019 click

Read More

For more information about Market Data on 15.01.2019 click

Read More

For more information about Reported Transaction (OTC) on 11.01.2019 click

Read More

Albanian Securities Exchange (ALSE) has the pleasure to inform you on the publication of the quarterly Statistical Report for the period October-December 2018 (Q4-2018). For detailed information on the report, please click here